Watch Cogitate Claims Fraud

Network Analysis in action

Fraud Network Graph and Fraud Prediction

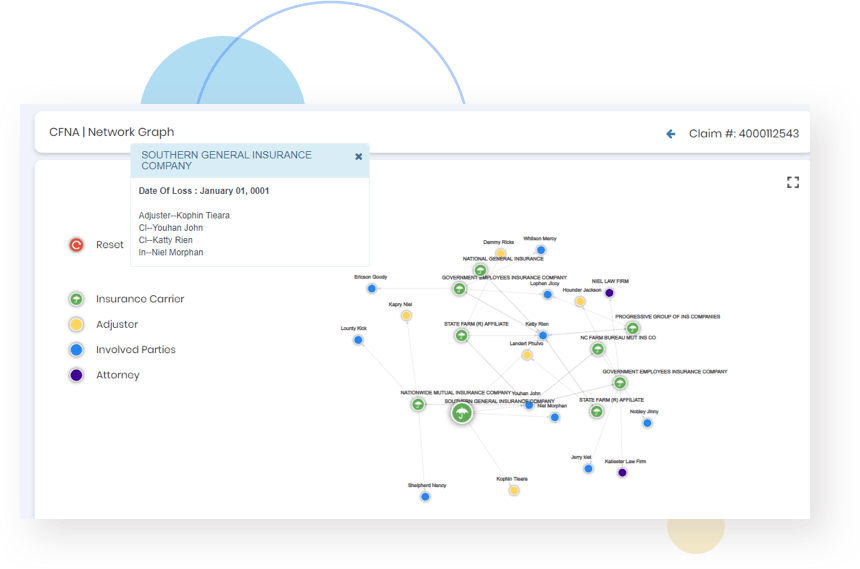

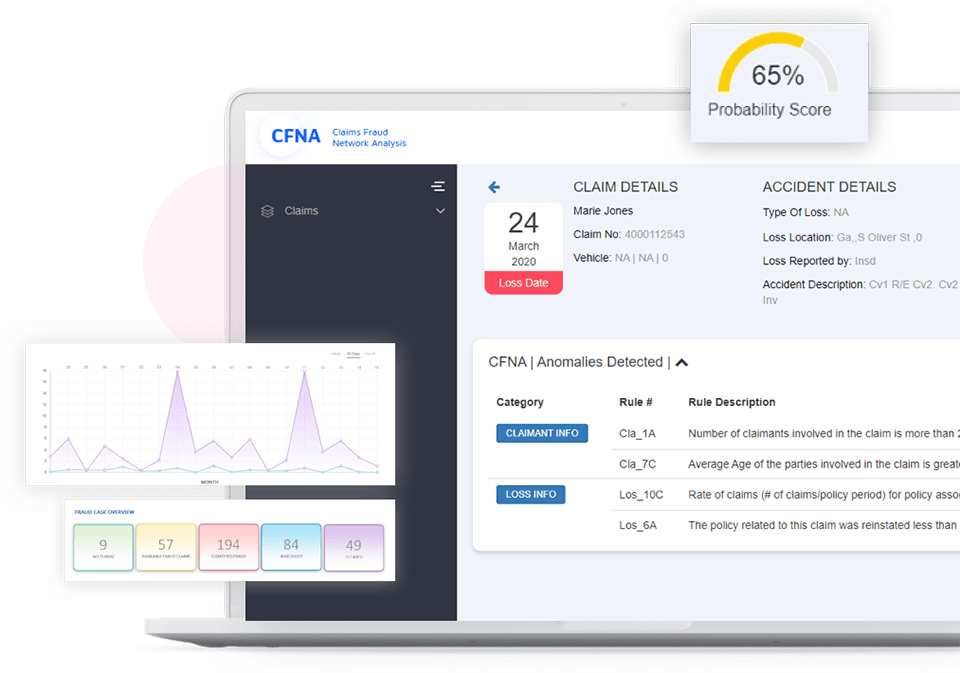

Cogitate CFNA combines ultra-modern technologies to help a claims team identify potentially fraudulent claims as they are reported. Using the claim information, Cogitate CFNA generates a fraud network map, including various parties (individuals and service providers) that may be involved in possible fraud. It also provides a fraud probability score along with supporting fact-based evidence, which help determine further actions to prevent substantial losses caused due to a delay in fraud detection or fraudulent claims not being detected at all.

Powered by Artificial Intelligence and Machine Learning

Cogitate CFNA uses artificial-intelligence-based complex algorithms and neural networks to identify fraudulent claims, based on the information provided in a claim. Scoring algorithms of CFNA use historical and other claims data to generate the fraud probability score of a claim and predict probability of fraud. Machine learning and deep learning models allow CFNA to learn new patterns of fraud and protect against future risks.

“Several of our friends in the business use the Cogitate solution. They highly recommended Cogitate for their industry expertise, solution capabilities and their friendly team who work with the customer to solve their issues. Our new claims system engages users throughout the claim lifecycle. It is helping our team to reinvigorate claims processes to improve customer experience, increase efficiency, and reduce operational cost. It is pre-integrated with various third-party data services and also with our other internal systems for real-time exchange of information.

Traders Insurance

“Cogitate Demand Management solution has so many features and benefits. We have significantly enhanced control over attorney demand claims exposure with this software. Demand Management solution helps us to ensure that no demand or a subsequent deadline is missed which can lead to bad faith. This is truly ‘sleep insurance’ for me when it comes to attorney demand letters. It’s an incredibly valuable tool for me as the Claims Vice President.”

Southern General Insurance Company

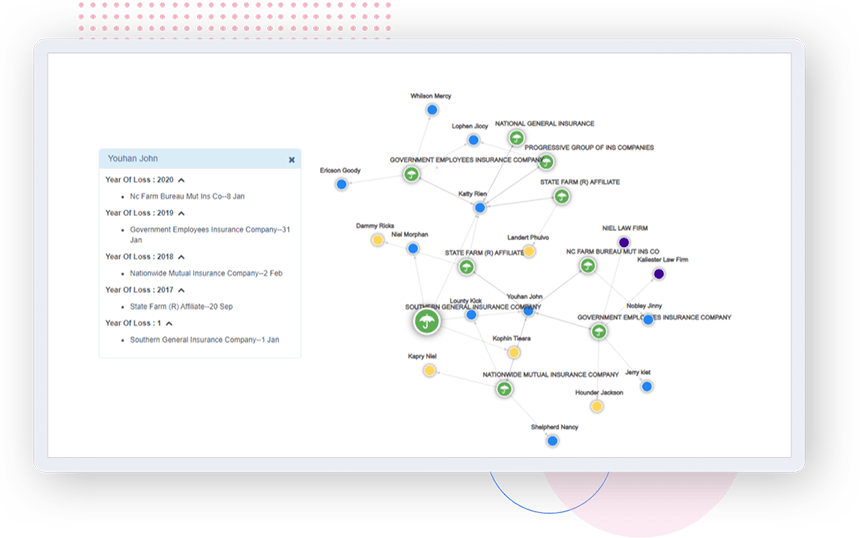

Faster Identification of Fraud

The most crucial aspect of fighting claims fraud is early detection. With the automated backend processing of Cogitate CFNA, fraud probability scores and network graphs are generated at the First Notice of Loss (FNOL) stage. The intelligent engine of CFNA constantly keeps analyzing new information throughout the claims life cycle and keeps the scores and the network graph updated. This ensures extremely fast detection of fraudulent claims and close scrutiny at every stage.

Fraud Collusion Network

- Identification of fraudulent parties involved in possible fraud, and creation of a network graph of all involved parties, based on their association

- Network of individuals who are part of claims historically

- Identification of fraud collusion network

- Multiple filters on network graph based on the various parties involved in the claim

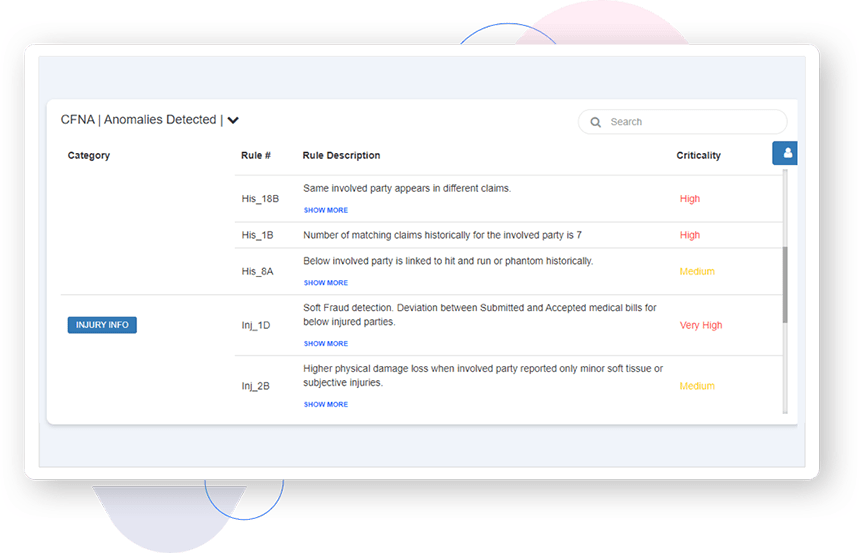

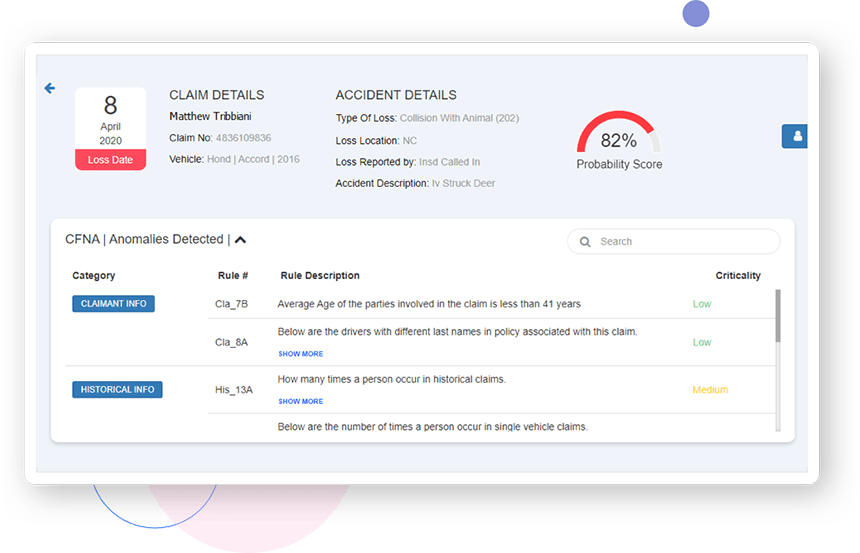

Anomaly Detection

- Anomalies identified based on more than 100 business rules

- Rules classified under various categories like historical information, claim information and more

- One-stop solution for identifying anomalies, with supporting evidence

Probability Score

- Generation of fraud probability score based on complex machine learning models and neural networks trained to identify fraud

- Machine learning model built based on years of claim data and associated research

- Identification of fraudulent trends within data very early in the claim cycle through the model

-

Fraud Collusion Network

- Identification of fraudulent parties involved in possible fraud, and creation of a network graph of all involved parties, based on their association

- Network of individuals who are part of claims historically

- Identification of fraud collusion network

- Multiple filters on network graph based on the various parties involved in the claim

-

Anomaly Detection

- Anomalies identified based on more than 100 business rules

- Rules classified under various categories like historical information, claim information and more

- One-stop solution for identifying anomalies, with supporting evidence

-

Probability Score

- Generation of fraud probability score based on complex machine learning models and neural networks trained to identify fraud

- Machine learning model built based on years of claim data and associated research

- Identification of fraudulent trends within data very early in the claim cycle through the model

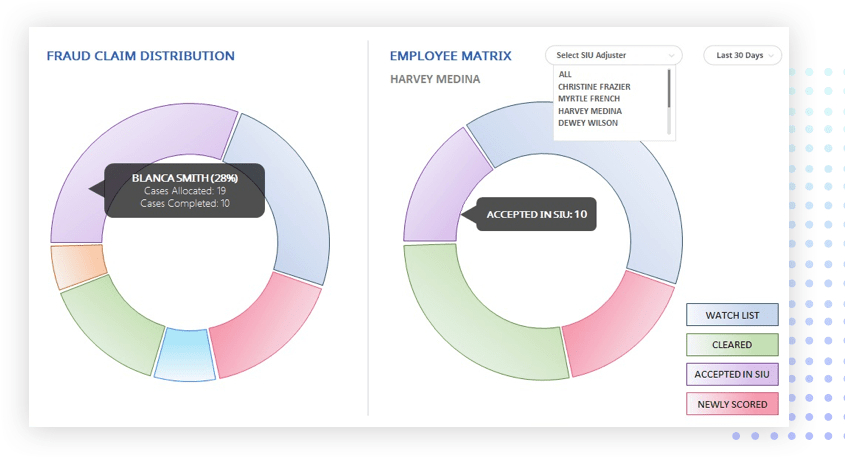

Improvement of Claim Cycle Time

Faster settlement of claims ensures enhanced customer satisfaction. Cogitate CFNA assists in segregating fraudulent and non-fraudulent claims, which is crucial to help adjusters settle non-fraudulent claims faster and refer the fraudulent claims to the Special Investigation Unit (SIU) at a very early stage. This approach helps in streamlining operations and improving the overall cycle time for claims settlement, thereby realizing significant savings in operational costs.

Claim Listing

- Listing of all open claims at different phases of a claim's life cycle

- Claims reflected in CFNA within 24 hours of FNOL (First Notice of Loss)

- Automated backend processing for data which can be scheduled and set up in off-business hours

- Automated assignment of claims to adjusters

Integration with Existing Claims Management Systems

- Can be integrated with client's existing Claims Management System

- Can be integrated with multiple client data sources to gather information

- Synchronized processing through sync agent ensures data is always updated in CFNA

Single Sign On

- User rights and access management through LDAP/Active Directory

- Predefined rights management for claims directors, managers and adjusters based on their roles and responsibilities

- Uses Cogitate's proprietary SSO module

Interested in learning more about our Claims Fraud Network Analysis?

DOWNLOAD DATASHEETLooks like something is wrong. Kindly verify your email address.

TRY AGAIN!

Watch Video

Watch Video